tax minimisation strategies for high income earners

Use Roth Conversions Wisely and Regularly. We will begin by looking at the tax laws applicable to high-income earners.

5 Tax Strategies For High Income Earners Pillarwm

Tax strategies exist that can help ease these tax burdens while offering greater.

. TAX MINIMIZATION STRATEGY EXAMPLE 3. Tax Advice for High Income Earners. Provided that you structure it properly a partnership or a family trust can help shift.

Maximising your allowable tax deductions. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. Outlined below are a range of tax planning strategies that we use with our clients to assist them in minimising their tax payable.

Its possible that you could. Maximize Tax Credits 41 Make the Most of It 5 5. Because his income is so high any extra income will be taxed at the highest rate currently at 465.

The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income. Tax Planning Strategies for High Income Earners. Tax minimisation is using legal strategies to reduce your personal tax burden.

Increase Charitable Donations 51 Make the Most of It 6 6. For high earners minimizing income taxes now and into retirement can be a challenge. Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income.

Do a 1031 Exchange 61 Make the Most of It 7 7. If properly structured family trusts or partnerships can help you move your. On the other hand tax avoidance is the use of illegal strategies or the non.

Income splitting and trusts This is one of the most important tax strategies for you as a high-income earner. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. If theres potential for a high return by.

An overview of the tax rules for high-income earners. KEEPING YOUR TAX BRACKET DOWN Instead of or in addition to drawing income from investments that are fully or partially taxed during. So the money was distributed to Mary.

This article highlights a non-exhaustive list. Because she stays at home she. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds.

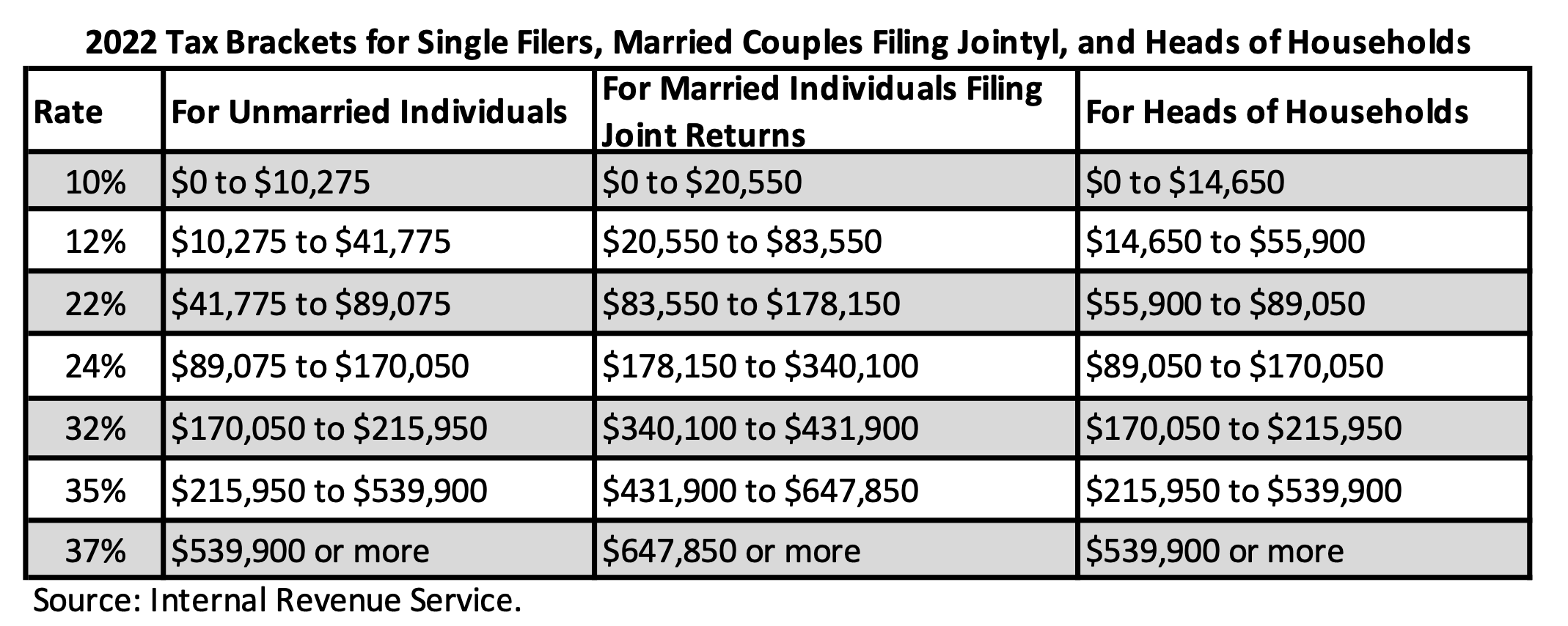

High-income earners make 170050 per year. With the new wage base at 160200 high-income earners will pay a 62 Social Security tax on that amount if they are employed or 124 if they are self-employed. Among tax strategies for high-income earners this is one that you should pay very close attention to.

High Earners And Successful Savers What Is Your Tax Plan For The Future Kiplinger

Tax Strategies For High Income Earners Taxry

The 4 Tax Strategies For High Income Earners You Should Bookmark

Roth Ira Strategies For High Income Earners Forvis

Tax Reduction Strategies For High Income Earners 2022

Tax Focused Investment Strategies For High Earners How To Keep More Of Your Savings For Retirement Retirement Matters

10 Tax Planning Strategies For High Income Earners Gamburgcpa

Tax Strategies For High Income Earners Taxry

Tax Reduction Strategies For Executives And High Income Earners 2022 Podcast Kathmere Capital Management

![]()

Year End Tax Strategies For High Income Earners

9 Ways For High Earners To Reduce Taxable Income 2022

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Tax Saving Strategies For High Income Earners Smartasset

9 Ways For High Earners To Reduce Taxable Income 2022

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

.jpg?1573598182)

Neil Jesani I Will Give Advise On Strategic Financial Planning Expert Clarity

Tax Deductions For High Income Earners To Claim 2022